Basketball is back! After a long off-season, it was fun to see the league back in action last night, with a great game between the Celtics and Sixers followed by the Warrior’s ring ceremony and easy win against the Lakers.

Seeing the Warriors’ roster all together (bruises and all), with the recently extended Jordan Poole and Andrew Wiggins reminded me what a talented (and expensive) group they’ve put together this season, and got my mind churning on something…

NBA Luxury Tax Overview

For years, I’ve been aware that the NBA has a luxury tax. The general principal is this:

- the league has a “soft” salary cap - a total salary bill which teams can only exceed for certain reasons (resigning players currently on the team is primary use case)

- on top of the soft cap, there is also a “luxury” cap, designed to discourage spending on salaries above a certain threshold

- the luxury cap exists to disincentivize rich teams from completely out-spending smaller teams on player salaries

- for teams with salary bills which exceed the luxury cap, each dollar of overage accrues greater and greater penalties, which the offending team must pay out to the other teams in the league which do not violate the luxury cap themselves

Conceptually, this is a simple model. However, I don’t think I had every fully internalized the mechanics of how the cap overage penalties work, and how fantastical some of the numbers they can produce are - until I started running the numbers on this season’s Warriors team.

With that in mind, I’d like to introduce a two-part series of updates which will help break down this system - the first being this post, diving into the multipliers, and the second post coming shortly and focusing on the 2022-2023 Warriors’ roster.

Luxury Tax Multipliers

The way the NBA has constructed the luxury tax system is as a set of ascending penalty buckets in five million dollar increments. Jump from one to the next, and each incremental dollar of salary will be penalized at the higher rate - much like how the IRS taxes personal earned income.

For first-time luxury tax violators, these penalties start at 1.5x the salary overage for the first $5M, and increase by roughly +0.5 per $5M of salary over the threshold. For teams which have repeatedly violated the luxury tax in the past, the penalties are a rung higher, but then move in parallel through the salary overage bands.

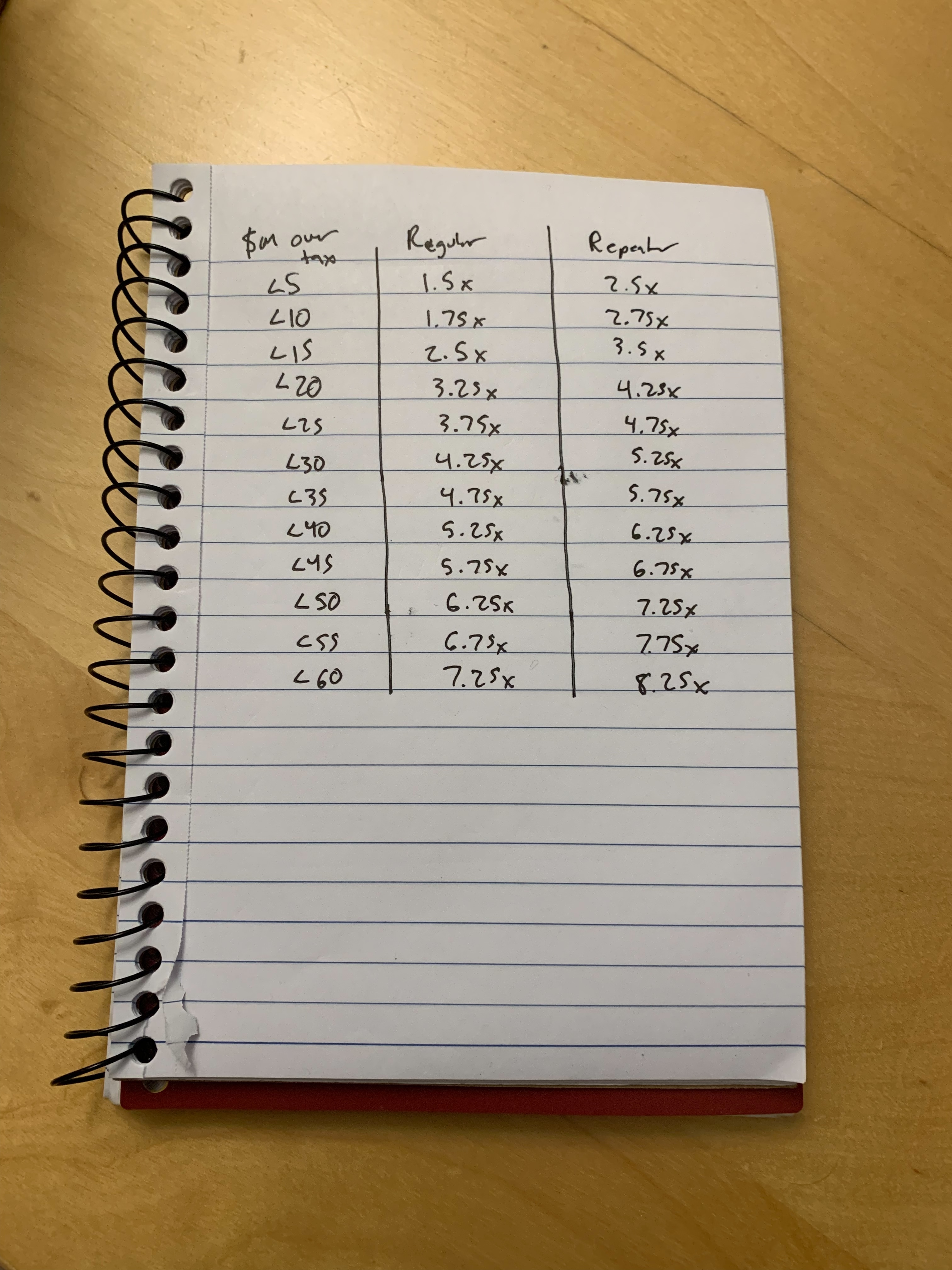

A quick reference table of the data was curiously difficult to find online, so once I got a handle on the rules that applied, I wrote out the regular and repeater multipliers for each increment of $5M - please enjoy my terrible handwriting below:

Some Examples

- In the simplest case, a team (which had not previously been charged the luxury tax) with a $3M salary overage will be charged a tax penalty of $4.5M (first $3M x 1.5)

- For another non-repeater, if they had $14M of salary over the threshold, they would be charged $26.25M (first $5M x 1.5, second $5M x 1.75, final $4M x 2.5)

- Interestingly, a repeater with $10M of salary over the threshold would be charged $26.25M as well (first $5M x 2.5, second $5M x 2.75)

Modeling Cumulative Tax Penalties

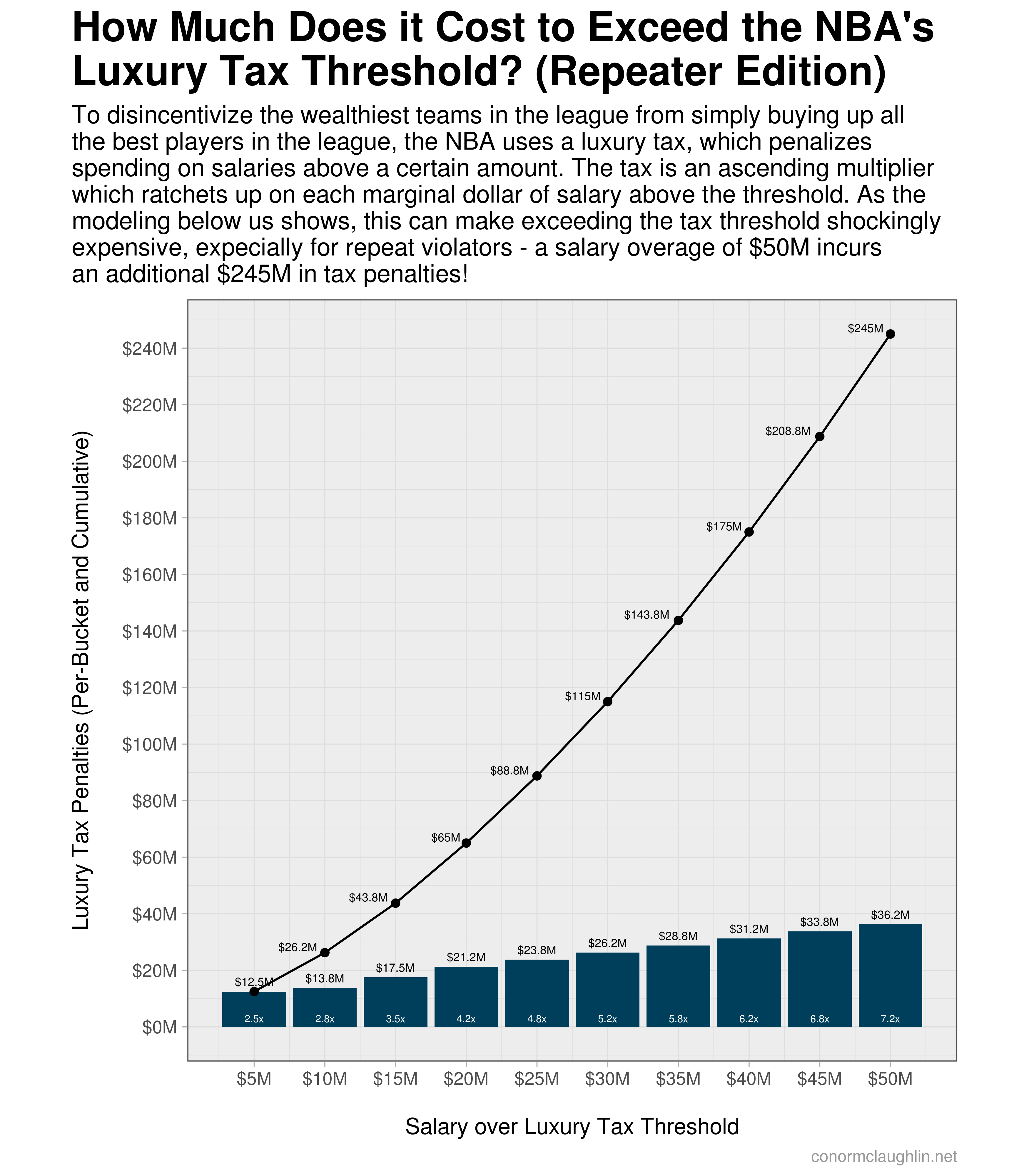

If you’re like me, the concept of increasing marginal penalties probably triggered a tiny corner of your mind which thinks about curve slopes, which sat there for a second and then said, “hey! doesn’t that mean that the total luxury tax bill owed by teams accelerates pretty meaningfully as they add salary?” If so, you’re right on the money - it does end up costing teams a lot more money to add $5M in salary once they are already $20M over the threshold, vs something smaller like only $5M over.

In an attempt to make this phenomena more concrete, I have built a visualization that seeks to show three key things:

- The multiplier levels (repeater team rates shown in this example)

- The tax penalties specific to each $5M band of salary, exceeding the luxury tax threshold

- The cumulative tax penalties owed by a team paying salaries of $X million dollars above the threshold

Take a peek below!

Next Post

In the coming days, we’ll look at the league-leading salary bill the Warriors are set to pay for the 2022-2023 season, and compute luxury tax penalties as seen above so that we can understand the true cost of the massive tab they are set to rack up!